July 7, 2025

What a year! And we’re only halfway through. In this mid-year dispatch, we are expanding our report to include a summary status of many of the holdings our clients have.

The Economy

Our economy continues to be stable. And this is not just an advisor’s offhand comment attempting to pacify his clients. The jobs report came out last Friday and unemployment continues to stay very low, dropping from 4.2% to 4.1%. This means that virtually everybody who wants to find a job can find a job. The number of New Hires in the economy for June, 147,000, was also favorable although some economists noted that a high percentage of the new jobs came from government (73,000) and healthcare (58,600).

Inflation at the end of May, the latest data, was an annual 2.4%, viewed favorably by economists and very close to the Federal Reserve’s 2% target rate.

Unemployment trends will be an interesting to monitor in the future. We have several influencing factors. First, we continue to see large numbers of baby boomers retiring, averaging about 10,000 per day. That is a whopping 300,000 people leaving the workforce each month. Those job openings may actually help the large number of layoffs we expect to see from the effects of artificial intelligence wiping out jobs. We have already seen a forecast of significant job loss in the computer industry and in office administration areas, such as insurance. Added to this, population growth will continue to shrink and immigration has decreased significantly. The combination of all of these factors may lead to a stable job market, but could result in lower economic growth.

The effect of tariffs and tariff talks has ended up being muted. On-again-off-again tariff measures and threats have had little overall effect on supplies, prices, and inflation. How could this be? Many economists have said that most of what the average consumer spends their money on is not related to tariff products. When you think about it, the average household spends most of its weekly paycheck on things like utilities, insurance, groceries, and mortgage or rent. We may only buy that pair of running shoes made in Vietnam once a year. Indeed, only 35% of all that we spend in this country is for non-service goods.

Another way to look at the muted inflation effect of tariffs is to understand that households only have so much money to spend from their paycheck. So, if tariffs drive the price of those shoes up, the consumer does not magically have additional money to buy them. As a result, the shoes will not be sold or the sellers must reduce their profit to sell the shoe—at a lower price than what the tariff would add. The only way we will have more money to spend on those imported shoes is if the government prints more money for them, which is the heart of all inflation. As you can see, however, if those shoes are not sold, and the government does not print more money, we may not have more inflation, but we could have a slowing economy.

As investors have come to realize the smaller impact from tariffs, financial markets have stabilized and even reacted favorably. Because of the muted effects of tariffs on our economy, we should not be alarmed by all the (future) threats and maneuvering we hear about.

The bottom line on all of this: Increased tariffs and lagging employment growth may not affect inflation very much, but they could slow down overall economic growth.

Big Picture Performance: Overall Markets

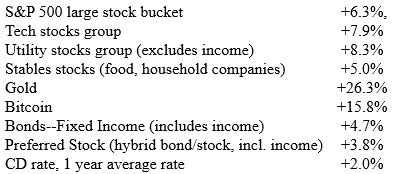

Here’s where we are as of today for the first half of 2025 for various sectors of the markets. Not that these figures have not been doubled to report an annualized rate. Except for the national average CD rate listed at the end of the list, the figures report actual performance for approximately six months only.

To put some of these figures into perspective, the average annual growth of the S&P stock index is 10%, so a 6.3% growth for half the year is nicely in historic range. And, when you consider that each of the previous two years saw this index grow by more than 20%, it is remarkable.

While the stock market, driven by tech company growth, has risen nicely during the previous couple years, fixed income bonds and utilities have lagged. So far this year, however, these sectors have done well.

Gold and bitcoin have jumped nicely during the turmoil of tariff issues and international conflict as investors look to invest funds in what they consider a safe haven. Safe utility company stocks have also benefited from this move.

Little Picture Performance: Specific Companies

The following a discussion of various major holdings from the firm’s core group that many of our clients own.

NVIDIA Corporation: The king of the artificial intelligence (AI) revolution has had an incredible climb, producing computer chips for governments, corporations, and various customers around the globe.

The company’s stock has increased in value over 18% in the last 6 months, and up over 1500% in the last five years. We continue to see excellent execution from CEO

Jensen Huang with a strategy of dominant innovation. The company has nearly no rival, with the closest competitor AMD (Advanced Micro Devices, Inc.) appearing far behind. Nvidia appears extremely well positioned to be the engine behind future technologies in the AI space.

Royal Caribbean Cruises Ltd.: Royal Caribbean has executed well in a post-pandemic environment, with large numbers returning to cruising. The stock has done well in our current environment, up over 43% year-to-date and over 550% in the last five years. Amazing.

Travel is an industry that has grown well in the past, and continues to grow as society progresses, and people have more disposable income which they desire to spend on high quality experiences and vacations.

The company itself boasts superior management starting with CEO Jason Liberty.

General Electric Company: General Electric is one of the best performers of our core group so far this year, up over 54% in the first 6 months of the year. This has been driven by the success of CEO Larry Culp, who has lifted an aged conglomerate from a stagnant question mark to currently a highly focused and dominant aerospace company.

The Progressive Corporation: Progressive Insurance stock is up roughly 11% in the first 6 months of this year. This is in addition to a stellar 230% return over the last 5 years. The company continues to show best-in-class fundamental growth and performance as an insurer. They have displayed industry-leading profitability on their auto insurance business, and continue to gain market share in the space due to their highly competitive pricing. This, paired with an attractive valuation relative to the market make this company one of our top bargains for the year so far.

Alphabet, Inc. (Google): Google has lagged the rest of the market so far this year, down about 5% due to numerous fears which have caused many to possibly overlook one of the greatest opportunities in the market.

These fears include a potential breakup of the company’s various businesses due to the dominance of their search business, driving a lawsuit from the DOJ on the grounds of their being an illegal monopoly.

Another fear from investors is the rise in competitors such as ChatGPT and other forms of artificial Intelligence that could hurt Google’s Search business.

It is quite rare to find a company like Google selling for so cheap relative to its profits due to fears that are so clearly in opposition to one another: The company is thought of by many as both an illegal dominant monopoly, but at the same time thought to be losing share to the competition.

The company has continued to grow all four segments of its business: Search, YouTube, Google Cloud, and Waymo. Search leads the way providing the majority of the company’s revenue and profits, while Google Cloud has continued to be their fastest growing segment and will likely continue to show accelerated growth in profitability and revenue. Many analysts argue that if the company were broken up due to the DOJ suit, leaving investors with shares of its separate businesses, the parts would be worth more than the whole. A rather attractive outcome regardless.

When viewing Google as a company, one simply must mention Waymo, which is the highest quality totally self-driving vehicle businesses in the market today. It continues to expand, having provided over 10 million driverless rides in 5 different cities. Waymo has a significant lead over any competitors in their deployment of driverless taxis. This has tremendous potential.

Overall, Google is an incredibly resilient company that continues to grow every portion of its business, providing an excellent opportunity to investors.

Amazon.com, Inc.: Amazon’s stock price has lagged the rest of the market for these first 6 months, being break even so far this year. There is no other company with a more efficient and expansive logistics network than Amazon. The ability to receive a package in a mere day or two, even the same day as ordering, is something that can only be accomplished by a truly wonderful business.

Overall, we continue to be impressed with the execution of CEO Andy Jassy, the successor to longtime Founder-CEO Jeff Bezos. Jassy was the leader of their fast- growing cloud division Amazon Web Services before taking over his role as CEO. The majority of Amazon’s profits are from Amazon Web Services, which is the largest cloud services provider in the world. Jassy has been a crucial part in increasing the profitability of this segment while simultaneously expanding into the growing cloud market. Amazon has also been expanding their profitability of their marketplace in a steady manner, leading to outsized potential profits for investors.

We continue to watch with excitement their ability to innovate in the field with both their marketplace, cloud division, and even the use of Artificial Intelligence to improve their business.

Duke Energy Corporation: This stable utility provider’s stock price has been up roughly 9% this year, quite substantial for a company that pays a hefty dividend (3.56%) to investors in a sector that usually grows slower than the overall market.

The growth of the stock price is primarily due to trade uncertainty driving many investors into more “defensive” utility companies. The company has also seen gains thanks to their sizable footprint in nuclear energy, a form of power that has been gaining traction as the world grows hungrier for the energy necessary to drive further digital innovations in artificial intelligence.

Individual data centers powering AI can take more energy than some cities. It is likely that Duke will continue to be a well-run beneficiary of our ever-growing need for power, and appears well positioned to offer a source of both income and gains for investors.

Apple Hospitality REIT, Inc.: This hotel-focused Real Estate Investment Trust (REIT) is down nearly 24% on the year. Ouch. This has been due to pressures from higher-for-longer interest rates, which both compete with the high dividend yield of this stock causing investors to buy treasuries and corporate bonds, and make the business of companies such as REIT’s more expensive due to their having to pay higher interest on their debt.

The company has a strong balance sheet and a very reliable business in owning hotels, which provide a great deal of cash flow used to pay its 8% dividend. This company is one of our recommended bargains for the income-focused investor who still wants to invest in the stock of a well-run business.

Visa, Inc.: Visa stock is up an amazing 12% during these first 6 months, along with having increased roughly 83% over these last 5 years. The company has continued to perform quite well in its fundamental growth within its tollbooth-like business. Every time a Visa debit or credit card is swiped, Visa collects fees for the use of its broad network to connect the merchant to the buyer. We continue to see a solid runway for growth in their business; they are well positioned to grow as more people around the world use digital forms of payment.

Booking Holdings Inc.: Booking Holdings (Booking.com and priceline.com) stock price is up roughly 16% during these first six months, along with being up a phenomenal 242% over the last five. They provide to worldwide customers an effective computerized travel platform for access to hotels, airlines, car rentals, and anything else related to your trip.

Palo Alto Networks, Inc.: Palo Alto Networks stock has outperformed the market so far this year being up 12%. This dominant cybersecurity provider has experienced outsized returns over the last 5 years, well over quadrupling its stock price. The company is well-positioned to continue growing in the cybersecurity sector, allowing clients to be invested in making sure the digital services we use daily are as secure as they are useful.

Their CEO Nikesh Arora continues to successfully implement a strategy of “platformization,” bundling their many offerings and secure platforms together to continue taking market share. Cybersecurity is a theme we see growing massively over the next decade, and investing in Palo Alto Networks is one of the ways we position our clients to benefit from such growth.

Apple Inc.: Apple has underperformed during the first half of the year, dropping in price by roughly 18%. This was primarily due to trade uncertainty, as Apple primarily develops their iPhone in China, with some production increasing in Vietnam and India. Apple continues to provide an excellent ecosystem of products between their phones, watches, and other products such as Mac computers. The iPhone has become one of the greatest products ever developed, with over 1.38 billion users worldwide, 18% of every single person in the entire world.

Apple CEO Tim Cook has primarily been focused on efficiency in delivering their current Products. Their approach of expanding their digital services such as the Appstore and iCloud has been successful so far, offering growth into a high-margin area while leveraging the success of their current products. The future challenge will be to create new groundbreaking products.

Overall, it does not seem that the Apple ecosystem and universe of products is going anywhere anytime soon, and there continues to be a great deal of potential profit for investors.

UnitedHealth Group Incorporated: UnitedHealth Group has had a substantial down year so far, dropping by 38% in these first 6 months. Double ouch. This has been due to a perfect storm of events that almost sound too wild to be true.

First, we had the highly publicized murder of UnitedHealthcare division CEO Brian Thompson. Then UnitedHealth reported quarterly earnings earlier this year with an uncharacteristic miss to their profit numbers due to rising medical costs. Finally, CEO Andrew Phillip Witty resigned, offering only “personal reasons.” for the exit. These events have left markets in a state of shock, dropping the price of the company significantly, but ironically, without too many fundamental changes to their business.

The good news is that the highly successful former CEO of UnitedHealth Group, Stephen J. Helmsley, after leading the company from 2006-2017, has returned to the CEO position to offer stability and continuity. It also helps that he has displayed a great deal of public confidence in the company, including his personal purchase of $25 million of UnitedHealth Group stock.

Rising medical costs of the company appear to be an addressable issue; they would simply need to offset their costs by raising premiums where necessary as they always have. Considering that this appears to be a sector-wide issue for Medicare advantage plan providers such as Humana, it is possible that UnitedHealth Group will use this time to take market share as they use their current advantages and dominant position to offer superior prices on their plans compared to other companies, even with any necessary increases.

Lastly, there seems to be some reprieve being offered by the federal government in the form of the payments for Medicare Advantage plans, with an increase of 5% in 2026, as opposed to the smaller increase of 2.8% that was given in their earlier estimates.

Overall, we see the current price situation with UnitedHealth as a great buying opportunity for investors. Despite fears surrounding the company’s leadership, the situation does not seem to have any fundamental effects on the company’s business. Stability is returning to the company with their cost issues appearing more manageable by the day. We see the nearly 40% price downswing to be an overreaction. We continue to recommend the stock due to its dominant position as the largest health insurer in the United States.

VanEck Preferred Securities ex Financials ETF (PFXF): PFXF stock price has been stable during these first six months while producing a very positive 8% dividend income yield. The payments are paid monthly, making it a great option for investors who need income regularly. The fund’s holdings are diversified across many utilities and large companies such as Ford, AT&T, and HP, with the ex-Financials part of the name reflecting that the fund does not invest in any banks or financial institutions, where there is apt to be more volatility.

With interest rates projected to drop somewhat over the next year, we also see room for the fund to appreciate in price. Even with no improvement from a price perspective, however, roughly 8% return on a fixed income investment is phenomenal, and there are many clients we continue to buy more PFXF in order to provide the steady income they need for their retirement income.

Corporate Bonds (Various): Corporate Bonds that we’re purchasing currently continue to offer attractive rates of 5.5%-6.0% and now may be a great time to buy given the projected falling rate environment. For our clients currently invested in these bonds, you may see your accounts rise in value as the market attempts to price in lower future rates and less attractive fixed-income opportunities moving forward by raising the price of said bonds. Corporate bonds continue to provide a stable fixed-income opportunity with the bond principal and payments being guaranteed by the company which issues them.

Outlook

If you’re still there, or just skipped to this section, we’re almost finished.

Short term fluctuations, whether up or down, can be dangerous to watch and react to. And even to predict. As the saying goes, even the hands on a stopped clock are correct twice a day, and some forecasters are sometimes correct. But be careful assuming that markets will crash in July, or that the next 12 months will be totally wonderful. Often, events that nobody predicted moved the financial markets. Think about the surprise of Covid.

During Covid the share price of Royal Caribbean stock plummeted from $133 to $24, a collapse of 82%! That drop in valuation was driven by emotional fears and was wildly incorrect. The price of the stock now, for the same company just four years later, is more than $330 per share. Is this dramatic upswing to such a lofty price correct? Given their predicted continued growth, perhaps it is. But perhaps not, too.

As always, our focus continues to be on the long-term quality of an investment and the specific company’s characteristics behind the investment. Royal Caribbean is one of those companies that is very well managed in a very good industry. It is a quality investment and is an example of a company’s stock we continue to recommend.

We hope you all had a wonderful 4th of July, and if you’re in Florida, stayed out of all the rain.

The Dougherty Team

A Tradition of Excellence

Patrick Manconi: Patrick has actually been with us for some time but initially joined us as a college student intern. He joined Dougherty Investment Advisors in May, 2023. He is a registered Investment Advisor Representative registered with the State Office of Financial Regulation in both Florida and Texas. Patrick played varsity football for the Division I University of South Florida Bulls, being selected to the American Athletic Conference All-Academic Team during his time there. His college majors in both engineering and finance contribute to his analytical approach to financial planning and portfolio management. At Dougherty Investment Advisors, he focuses on delivering personalized investment strategies to individuals and families alike. Outside his professional life, Patrick is involved in his local community and enjoys weightlifting and physical fitness.

Patrick Manconi: Patrick has actually been with us for some time but initially joined us as a college student intern. He joined Dougherty Investment Advisors in May, 2023. He is a registered Investment Advisor Representative registered with the State Office of Financial Regulation in both Florida and Texas. Patrick played varsity football for the Division I University of South Florida Bulls, being selected to the American Athletic Conference All-Academic Team during his time there. His college majors in both engineering and finance contribute to his analytical approach to financial planning and portfolio management. At Dougherty Investment Advisors, he focuses on delivering personalized investment strategies to individuals and families alike. Outside his professional life, Patrick is involved in his local community and enjoys weightlifting and physical fitness. In addition, Melissa LeMasters has joined the firm as an administrative assistant. Melissa comes from the beautiful hills of West Virginia where she spent almost 20 years as an office manager for a small coal company; involved in various accounting and administrative areas.

In addition, Melissa LeMasters has joined the firm as an administrative assistant. Melissa comes from the beautiful hills of West Virginia where she spent almost 20 years as an office manager for a small coal company; involved in various accounting and administrative areas.